In 2024, the US government announced that it would impose a 10% import tariff on certain goods from China, Southeast Asia, and other places, involving core cross-border e-commerce categories such as electronic products, textiles, and household appliances. This policy is interpreted as an important measure to protect local manufacturing and balance trade deficits, but it also has a direct impact on cross-border e-commerce and international freight industries that rely on global supply chains. According to data from the United States International Trade Commission (USITC), this tariff adjustment is expected to affect about $180 billion in imported goods, covering more than 30% of cross-border e-commerce product categories.

This policy is not only a continuation of the economic game but also an inevitable result in the context of global supply chain reconstruction. For cross-border e-commerce and international freight companies, how to cope with rising costs, declining logistics efficiency, and intensified market competition has become a key proposition for survival.

The direct impact of tariff increases on the industry

1. Cross-border e-commerce: rising costs and compressed profits

- Commodity price competitiveness weakened: Taking the clothing category as an example if the cost of a single package increases by 10%, the selling price needs to be increased by about 8% to maintain the original profit, but it directly leads to a decline in consumer willingness to buy. Sellers on platforms such as Amazon and eBay reported that the order conversion rate in the second quarter of 2024 has dropped by 5%-12% month-on-month.

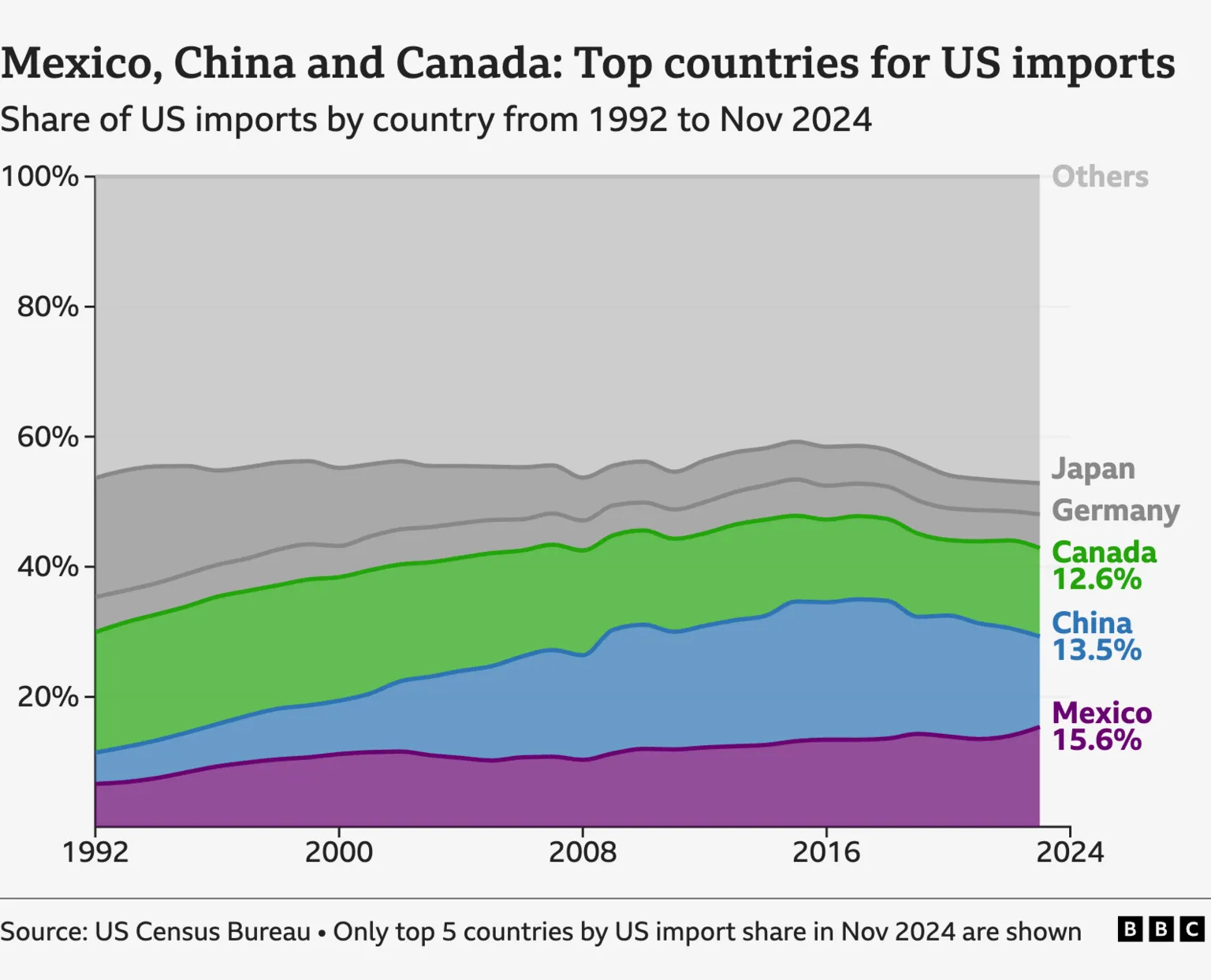

- Supply chain reconstruction pressure: Some companies have tried to transfer production capacity to Mexico, Vietnam, and other regions that have not been taxed, but in the short term they face problems such as long factory construction cycles and insufficient worker skills. The capacity ramp-up cycle of fast fashion giants such as SHEIN in Mexico is expected to last up to 18 months.

- Compliance risks are increasing: The US Customs has tightened its review of certificates of origin and commodity codes, and the cargo detention rate of small and medium-sized sellers due to omissions in declarations has increased by 37%.

2. International freight: freight rate fluctuations and model transformation

- Ocean freight cost transmission effect: The freight rate of 40-foot containers on the US West Coast route has exceeded US$5,000, and the superposition of tariffs has caused the overall logistics cost ratio to rise from 15% to 22%. The profit margin of freight forwarding companies has been compressed to a critical point of 3%-5%.

- Demand for multimodal transport surges: To avoid port congestion and tariff risks, companies turn to hybrid modes such as “China-Europe Express + Mexican land transport,” but insufficient railway capacity has extended the waiting period for China-Europe Express bookings to 2 weeks.

- Adjustment of warehousing strategy: The overseas warehouse stocking cycle has been shortened from 30 days to 15 days, but the increase in inventory turnover requirements has led to a 20% increase in warehousing costs.

Industry breakthrough: Four core solutions

1. Supply chain optimization: from “cost-oriented” to “elasticity first”

Diversified production capacity layout:

Establish “tariff-friendly” production bases in free trade agreement countries such as Vietnam and Turkey. For example, Anker’s charger factory in Turkey has achieved zero tariff exports to the EU and used the US-Turkey trade agreement to reduce the cost of entering the United States.

Nearshore procurement and localized production:

The Mexican “customer factory” (Maquiladora) model is popular, and companies circumvent finished product tariffs through local assembly. Tesla’s super factory in Mexico can reduce the export cost of Model Y to the United States by 12%.

2. Tariff avoidance strategy: cost control under a legal framework

Use free trade agreements (FTAs):

Apply for origin certification (such as RCEP, USMCA), and products that meet the “substantial transformation” standards can enjoy tariff reductions. A furniture company successfully reduced the tariff rate from 25% to 0% by processing Chinese-made panels into finished products in Vietnam.

Split declaration and tariff classification optimization:

Complex products (such as clothing containing electronic components) are modularized and declared separately as low-tax components. A smartwatch company reduced its overall tax burden by 40% by separating the strap (tariff 6%) from the watch body (tariff 3.5%).

3. Innovation in international freight model: rebalancing efficiency and cost

“LCL + overseas warehouse” model:

The goods of multiple sellers are shipped to the US overseas warehouse in LCL, and the “321 small tax exemption” policy (tax exemption for packages below US$800) is used to split them into small packages for direct mail. A Shenzhen 3C seller reduced the logistics cost of a single piece by 18% through this model.

Application of digital logistics platform:

Use Flexport, Freightos, and other platforms for real-time price comparison, and dynamically select the combination of “sea + rail” or “air + truck.” A Hangzhou clothing company shortened the transportation time from Los Angeles Port to Chicago by 4 days through algorithm optimization.

4. Policy coordination and compliance upgrade

Tariff exemption application:

For strategic products such as medical equipment and new energy components, apply for exemption by citing Section 301 of the Trade Act 1974. In 2024, 23 Chinese companies will have obtained tax exemption qualifications by proving “irreplaceability.”

Deeply bind local partners:

Establish a joint venture with a US distributor and apply a more favorable tax rate as a “local entity.” A Ningbo home appliance company transferred the tariff costs to the local sales link by acquiring a South Carolina distributor.

Future trends: industry reconstruction and long-term strategies

1. Accelerated digital transformation

- Blockchain traceability system: Walmart has required suppliers to use the IBM Food Trust blockchain platform. In the future, tariff compliance will rely on full-link data transparency.

- AI tariff prediction tools: CargoAi and other companies have developed algorithm models to monitor changes in US customs policies in real time and warn of risk categories.

2. ESG-driven supply chain changes

- Green tariff barriers emerge: After the EU carbon border tax (CBAM) pilot, the United States may follow up with “environmental tariffs” on high-carbon footprint products, forcing companies to use new energy transportation tools.

3. Normalized response to geopolitical risks

- Establish a “supply chain resilience fund”: leading companies reserve 3%-5% of revenue as emergency funds for capacity allocation and inventory buffers during tariff fluctuations.

Conclusion: Strategic opportunities in the crisis

The US tariff increase is a challenge on the surface, but it is a catalyst for industry upgrading. Through supply chain resilience construction, tariff compliance innovation, and logistics digitization, companies can not only hedge short-term cost pressures but also build core competitiveness for the future. As the president of UPS Global Forwarding said, “Tariffs are not the end, but the starting point of Globalization 2.0 – only those who adapt to the rules can define the new rules.”